Dad is Fat, and Payday Lenders are Thieves

- Aaron Hedges

- Aug 6, 2021

- 4 min read

On a recent family road trip (yes, “trip,” not vacation) from Knoxville, TN, to the Brainerd Lakes Area of Minnesota, my wife and I enjoyed passing some of the time listening to Jim Gaffigan’s audiobook Dad is Fat. In the midst of Gaffigan’s lighthearted and self-deprecating humor, he hit on a topic that grabbed my Partnership Economics attention:

Unfortunately, around the age of three, there comes a time when napping your child becomes counterproductive. It’s not worth it. The nap during the day for a three-year-old becomes a payday loan. For those of you who don’t understand the connection, a payday loan is for people who can’t seem to make ends meet until their next paycheck, so they go to a loan company (aka thieves) that will give them their paycheck amount early for a huge fee. This is of course unwise, and Suze Orman would be angry with you. It is equally unwise when applied to napping...

The napping humor/wisdom certainly rings true with me as a parent of young kids. Unfortunately, his barbs about payday loans are every bit as true, yet the kind of truth that even a humorous spoonful of sugar doesn’t quite help the medicine go down. That’s because, to borrow from church leader Ambrose fifteen centuries ago, what is taken as medicine (a loan to cover a financial need) becomes poison (expenses that perpetuate and increase financial need).

From Better Capitalism, where it was adapted with permission from an article by Stephen Reeves:

The typical interest rate and fee charges for a two-week loan range from $15–$25 per $100 borrowed. Those charges represent an annual percentage rate (APR) of 391 percent to 700 percent and can often climb even higher. Some states have no limit to the interest rate or fees that can be charged. At the end of the loan term, the borrower must either pay the entire lump sum, principal plus all interest and fees in one balloon payment or that amount will be automatically deducted from their bank account. As an alternative, the borrower can pay only the fee and interest and “roll over” the loan for another two weeks. At this point, despite having paid the hefty interest and fee, the borrower will still owe the entire principal plus another round of fees and interest. Lenders rarely accept partial payment beyond interest and fees, which ensures that the principal owed is never reduced. … A loan of $350 will commonly cost a borrower $800 or more to repay—frequently three to four times what was borrowed.

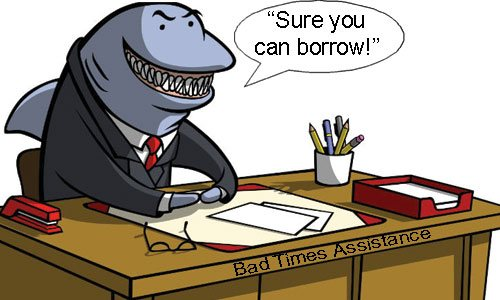

As Gaffigan says, getting a payday loan is unwise. Sometimes -- actually, more often than any of us like to admit -- people do unwise things, especially with money, due to the behavioral economic factors of ignorance, uncertainty, and confusion as we discuss in Better Capitalism. Sometimes people are in such desperate situations that, no matter how unwise something is, it may seem like there is no other option. Sometimes, as Gaffigan also says, thieves take advantage of other people. Payday lending is accurately called predatory lending; there is no partnership, no mutual benefit here -- these types of “loans” are preying upon others’ vulnerability. Sadly but truly, the term “loan shark” is well-deserved.

Photo Credit: Fairview Commercial Lending

In Better Capitalism, we address both individual behavioral factors and situational/structural factors. Positive change is not created by individuals blaming structures nor by structural powers-that-be blaming individuals. There are abundant problems in our current form of capitalism, such as predatory lending, but blame is not a solution. Solutions and positive change come from both individual responsibility and the common good being taken seriously, both individuals and structures interacting with mutual benefit.

While we don’t shy away from naming and condemning the problems of exploitative plantation economics, we intentionally give at least as much attention to constructive solutions in the form of mutually beneficial Partnership Economics. On the topic of payday loans, which are blatantly exploitative yet somehow legal, we offer “Partnership in Practice” actions for faith communities, elected officials, investors, and media. This is an area of capitalism where we the people can -- and need to -- enact positive change.

The truth will set you free -- but first it will tick you off. If you are ticked at the truths about predatory payday loans, that’s a good start. But remember, blame is not a solution. Complaining about a problem doesn’t resolve that problem. We invite you to channel righteous indignation about predatory actions into constructive action. One specific, actionable next step is to create or support a rescue loan ministry. Let's make payday loans obsolete by offering something better.

What about you? Share your story, question, comment, idea, disagreement -- yes, we welcome disagreement for the sake of mutual benefit! -- with us at blog@PartnershipEconomics.com. We will give a thoughtful response, with prioritized attention to emails from our subscribers. Subscribe here >>

Our Amazon #1 New Release: unleash more with Better Capitalism: Jesus, Adam Smith, Ayn Rand, & MLK Jr. on Moving from Plantation to Partnership Economics.

Comments